Global Systemic Crisis: How To Secure Yourself?

goldandlandsadmin November 6, 2022 No Comments

The global systemic crisis is a global event that has the potential to cause a major disruption in the world economy. It is not just about one single country or region. The crisis has become an international phenomenon that affects all countries, including developed ones.

The international financial system is very fragile and interconnected with other systems such as the energy, food and water supply chains, and the environment. Therefore, it will be difficult to prevent a systemic crisis from occurring again in the future this is because the world is facing global systemic crisis or what I call global mix challenges. The on-going financial crisis could be said not to be managerial failure, but government structural failure from my point of view. While federal government/government in power only deal with the symptoms and not the systemic cause is why the global security crisis linger more than the temporal solution.There are many ways to protect yourself from this disaster but you need to act now before it’s too late!

The era of fake money is gone says Egon. As the world faces economic, financial, and security crises, most people are giving up on whether to save their funds in the banks or to put them into any available investments. Countries/nations have adopted printing more money with huge payable debts like what we have seen happening in Nigeria and other western countries.

According to Egon von Greyerz (EvG), who is an expert in macroeconomics, massive money printing and huge amounts of unpayable debt will lead to a monster financial meltdown soon.

“Egon von Greyerz, a financial consultant at Evansville, Indiana-based asset management firm Greyerz & Partners, said the United States will enter into a financial meltdown if massive money printing and huge amounts of unpayable debt continue.

I forecasted that the stock market would fall at this particular point in time. The world would shut down and there would be some extra money printing, which would make people optimistic for a while. However, all money printed will have no effect on the world because it cannot drive it forward anymore. All decisions on top of energy, climate change, sanctions, and so on will mean that all crash a lot faster and there is absolutely no remedy for that. They are not going to be able to do anything about it.

Egon says that the era of promises and unrealistic goals has come to an end. He predicts that those who don’t have power will be thrown out and replaced by those who do. He says that gold is still the best solution during a financial crisis because it gives you value in times of uncertainty, unlike paper money. Egon says that we almost saw a collapse in 2008, but it was patched up temporarily. This time they won’t succeed.

While the Bank of England’s decision to postpone its asset sales program indefinitely has calmed fears over the United Kingdom’s economic future, tensions remain palpable on the 10-year yield, which has not regained the very symbolic level of 100 points consider.

The BoE decided to buy back British securities to curb the spectacular fall in the Gilt and German bond markets, which had triggered a margin call on British pension funds. The crisis then spread to other European countries and led to promises of financial aid from governments across Europe.

The German economy is suffering from a crisis in which the value of its bonds has fallen due to increased demand for both government and corporate debt securities. To help the country overcome its energy crisis, the German government has agreed to provide financial aid for German industry, which will enable it to overcome its energy crisis.

Read Also: Savings Vs. Investing: Why Sell Your Stocks To Buy Gold?

This is another blow to German savers, who will see the real value of their assets held mainly in euro-denominated debt securities plummet this year. If we add up the effects of inflation, the fall of the euro, and the fall of the Bund—and factor in factors such as inflation—it’s likely that savers will look grimly at the performance of their mutual funds for investments made during 2008.

Inflation continues to rise in Europe—with many blaming Central banks for stoking unrest through their monetary policies—yet these same banks are not being singled out for blame by those who are triggering uprisings across Europe. The complexity and obscurity of financial markets make them less accountable than they could be, and this is one of their main advantages over their modern-day counterparts.”

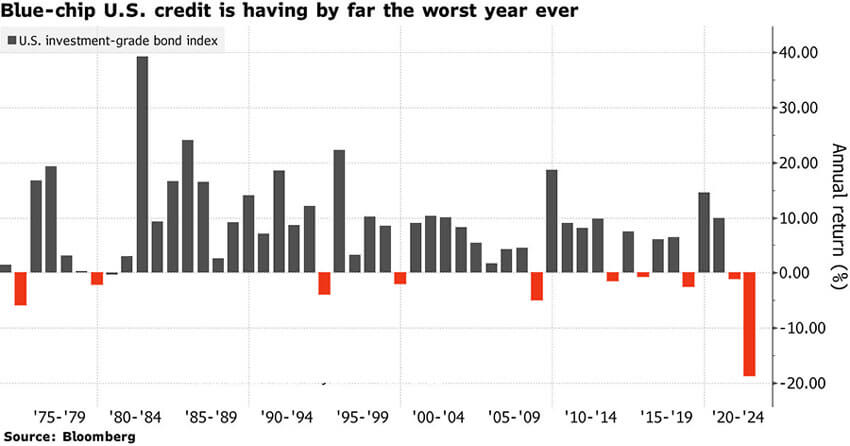

Bond crisis

The past few years have seen Japan print money to buy Japanese debt. This has driven the value of the yen down by 40 percent against the dollar since 2017, despite interventions by the Bank of Japan (BoJ), including buying the U.S.

Treasury bonds. Similarly to the European Central Bank’s purchases of European government bonds, these purchases are really worth something—the hard core of European banks’ capital—but are they really as liquid as they once were?

In recent months, buyers have become scarce in the U.S. Treasury bond market and this market no longer has enough liquidity to be an attractive investment.”

Credit crisis

The stock market decline of 2022 is exceptional because the decline in stocks is simultaneous with a decline in bonds. In general, when stocks fall, investors tend to buy bonds instead. But today, this protection no longer works. The corporate debt market is also destabilized.

For analysts at Bank of America, Credit Stress Index (CSI) has passed the threshold reached in June and is at the threshold of the critical zone where risks of malfunctioning of the credit market increase exponentially.

How to Secure Yourself From Global Systemic Crisis?

Have you asked yourself similar questions if whether to save money or invest these funds in the gold business to secure yourself from the current world crisis?

Well, your thoughts may not be different from most individuals with like minds. But if you, however, consider banks still your best option to save money rather than to invest, then you are missing out on the reality that the central banks which is the regulator of all banks are not as reliable as they use to be.

Also Read: 5 Reasons Gold May Rise Beyond Real Money

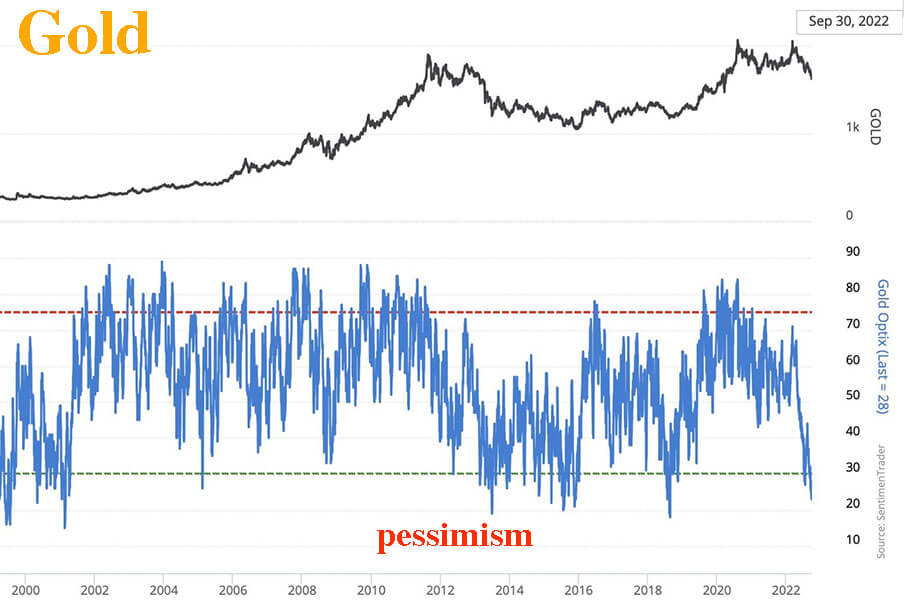

Although central banks are buying for themselves and accumulating all they can, India and China are accumulating gold, and there has never been so much gold leaving COMEX warehouses, it is strange that investors were at the end of September overly pessimistic about the future of gold prices.

When we look at what is happening in the equity and bond markets, we can reasonably expect that fund managers will invest in gold to preserve their portfolios. If we pay attention to commercial hedgers’ contracts, they have significantly reduced their short positions at 61,000 contracts—a level that has given hope for a strong bullish rally.

As a result, banks’ reserves are made up of government debt, which will never be repaid and is losing value every month. Double-digit inflation is a sign of this declining purchasing power. It is a form of currency devaluation; it’s just in its infancy.

Under such global geopolitical conditions, gold should soar to new all-time highs; this can happen in small steps so that it doesn’t shock people too much or more suddenly by diverting their attention by some spectacular event—which could happen at any time.”