5 Reasons Gold May Rise Beyond Real Money

goldandlandsadmin October 10, 2022 No Comments

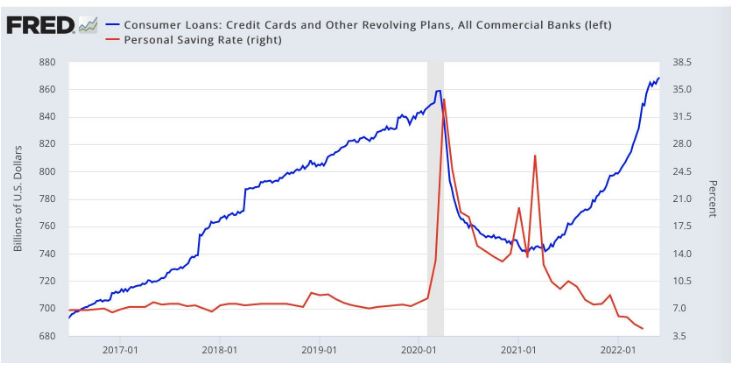

The current world debt most country’s are experiencing is larger than in 2008, but it is also different in nature. In particular, consumer debt is four times higher than in 2008, while the consumer savings rate is 50% lower. While the world may be facing such debt in different countries, gold has constantly sustain favorable rate. The question most individuals are asking what are the reasons for rise in price of gold.

As the inflationary spiral seems to be truly launched, uncertainty grows, especially on the markets. Investors take massive refuge in assets deemed liquid and of high quality, first and foremost gold and the dollar – the reserve and exchange currency par excellence. This “flight to quality”, which is well known to the markets, de facto depreciates most currencies against the US dollar.

While this depreciation is at first sight desirable because it strengthens the competitiveness of countries, it nevertheless increases the price of products quoted in dollars, i.e. most traded products. The price of raw materials, already at very high levels due to logistical problems, climatic shocks and persistent speculation, is rising even more. Countries outside the United States will thus suffer a double inflationary shock: the first linked to the economic recovery, and the second linked to the depreciation of their currency against the dollar.

In December 2021, faced with the continuing increase in consumer prices, the central banks made their confessions and recognized that the rise in prices was finally here to stay. U.S. Federal Reserve Chairman Jerome Powell declares that “inflation is not transitory.” As the appeal of the U.S. currency grows, the U.S. continues to export inflation around the world. At that time, price inflation reached 7% in the United States (the highest level since 1982), 5.3% in the eurozone (a record since the creation of the indicator in 1997), and 5.4% in the UK (the highest since 1992).

Three months later, on 24 February 2022, Putin declared war on Ukraine.

This geostrategic conflict, linked to the expansion of NATO, Russia’s de-dollarization policy, and the energy war between the United States and OPEC+, in turn leads to inflationary pressure. Since a large share of raw materials, especially agricultural products, comes from Russia and Ukraine, this war is creating new shortages. At the same time, the embargo on Russian gas by Western countries is causing energy prices to rise, accentuated by speculation.

Reasons For Rise In Price Of Gold May Influence Dollars

Beyond the structure of gold supply and demand, it is important to relate the evolution of what causes gold to rise. In 2019, jewelry accounted for + half of the gold demand, which totaled more than 4,400 tonnes, according to the World Gold Council. India, China, and the United States are large consumers of gold for jewelry in terms of volume. Therefore, gold prices was affected by the basic theory of supply and demand; as demand for consumer goods such as jewelry and electronics increases, the cost of gold can rise.

Also Read: Savings Vs. Investing: Why Sell Your Stocks To Buy Gold

Gold is sought after, not just for investment purposes and to make jewelry, but it is also used in the manufacturing of certain electronic and medical devices. Today gold represent a timeless store of value in a world of declining paper currencies. Gold tends to have an inverse relationship with another global reserve asset—the US dollar—which means that central banks can load up on gold to protect the value of their reserves when the dollar loses value. However, before investing in precious metals, it is important to understand the times in which we live and the market fundamentals driving the world back toward tangible assets in a world awash in debt and money substitutes.

Gold Reserves And Central Bank

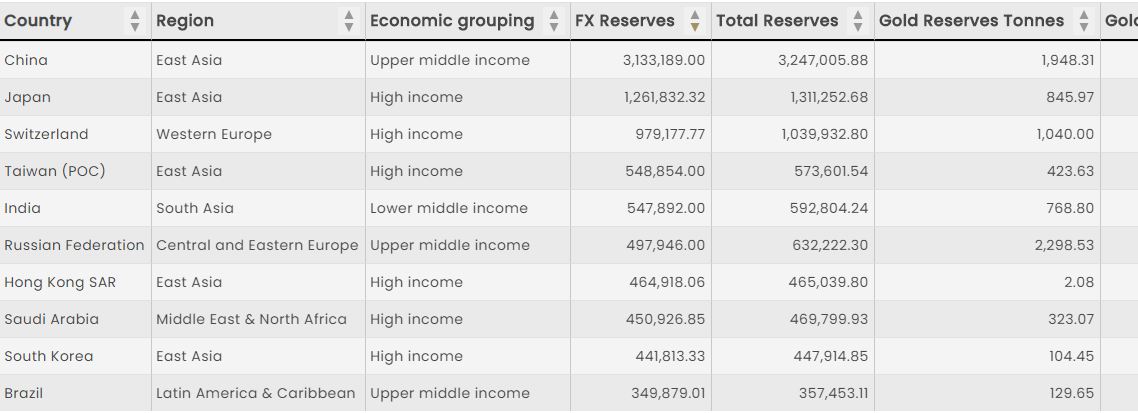

Central banks hold paper currencies and gold in reserve. As the central banks diversify their monetary reserves—away from the paper currencies that they’ve accumulated into gold—the price leading to the reasons for rise in price of gold. Many of the world’s nations have reserves that are composed primarily of gold.

Bloomberg reported that global central banks have been buying the most gold since the U.S. abandoned the gold standard in 1971, with 2019 figures dipping just modestly from 2018’s 50-year record. Turkey was the largest buyer of gold in 2019, followed by Russia, Poland, and China, according to the World Gold Council.

China, Japan, Switzerland, Taiwan (POC) India, Russian Federation, Hong Kong SAR, Saudi Arabia, South Korea, and Brazil hold the highest gold reserves (in tons). While there have been minor changes in positions over the years in the buying pattern by these nations and all others reflects the policy stance taken the central banks, based on macroeconomic factors, financial stability and global environment.

What Factors Cause Gold Prices To Rise Higher Over Time?

Some of these following factors are what causes gold to rise in price, which are:

- International factors

- Demand and supply

- Inflation

- Value Of the currency

- Taxes and import duty charges

International factors

Most of the gold in India, Dubai and China is imported and thus the international spot price of gold is a determinant in deciding the metal value of gold. The spot price is decided in the London bullion market. If due to certain conditions the spot price rises, the cost of gold will also rise.

Additionally, other international factors including war and peace that dictate the global movement of gold prices also affect domestic gold prices. So, if the international conditions resulting in tensions and uncertainty are present, gold prices might rise.

Gold Demand and Supply

Demand and supply: Demand and supply is one of the biggest factors, if not the biggest, that determine the price of any commodity. So is the case with gold.

When the demand for gold rises, the price will rise as well. This phenomenon can be observed around festivals, the wedding season, or after a good monsoon season profitable to the rural population.

Inflation

According to economist Milton Friedman, “Inflation is the one form of taxation that can be imposed without legislation.”

The Federal Reserve and the U.S. Government’s Consumer Price Index report inflation at 2-3% a year, yet common sense says real world inflation is likely twice that amount. When you factor in monetary inflation (printing money), asset inflation (stocks and housing) and price inflation (cost of living) it’s clear that inflation is rising much faster.

At the other hand, Gold is used as a hedge by the Indian masses and is their go-to investment. When inflation rises people tend to buy more gold for security thereby leading to reasons for rise in price of gold. Moreover, when inflation rises, the value of the rupee falls in the international market and this contributes to a higher conversion rate and hence causes gold to rise.

Value of the Currency

As mentioned before, the spot price of gold is decided in the London bullion market. This price is valued in American dollars, euros, and pounds. Henceforth, the value of the dollars influences the price of gold. When the value of the dollars falls, the exchange rate is higher. A higher exchange rate leads to a higher price.

Taxes And Import Duty

The amount of import is also a deciding factor in gold prices within the country. India is the second largest consumer of precious metals, therefore it needs to import gold in order to meet the demands. When gold is imported in India customs duty is levied on the shipment. So when a change in government regulations causes a rise in customs duty, the market price of gold is directly affected. Besides this, VAT, local taxes, and distribution costs depending on the demographic location add to the rate of gold. Accordingly, an increase in any of these factors pushes the price in an upward drift.

In conclusion, if we look into the current world happening and debt rate by most countries, most individuals who understand the Gold market would buy into the ideas of retaining their wealth in accumulation of Gold, than reserving their funds in banks while the dollar crumble in worth.